The Realo Estimate® for the new EBA Guidelines on Loan Origination and Monitoring

New EBA guidelines

In May of 2020, the European Banking Authority (EBA) published its final report on the new regulations concerning loan origination, titled Guidelines on loan origination and monitoring. A key aspect of this document is new regulations for the valuation of immovable property as collateral, as it reports that statistical models are allowed to be used for this purpose at the point of origination. Furthermore, starting January 1st 2022, loan institutions will be required to rely on independent third parties for the valuation of immovable property as collateral for loans. This valuation will then serve as the collateral value, as opposed to the purchasing price of the property. It is both expensive and time consuming to make an appraisal based on a physical visit of a property. As such, the above regulations create a need for quicker and less expensive valuation techniques without losing out on accuracy or robustness. Appraisals based in statistical modelling by machine learning algorithms fit this need perfectly.

The Realo Estimate®

Realo’s Valuation Engine is a state of the art automated valuation model that creates property valuations by using machine learning and artificial intelligence techniques. Since its conception in 2016, this project has seen major improvements and updates every quarter, and is currently considered the most accurate property valuation software in Belgium trusted by financial institutions, governments and real estate professionals.

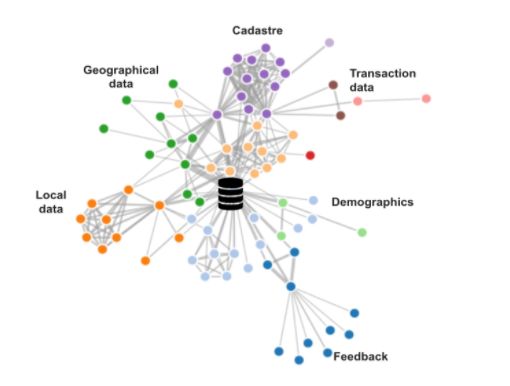

The engine analyses data from a wide variety of sources, making full use of publicly available data as well as listings and user feedback, and cross references these data points with a large data set of transaction prices. The resulting feature vectors are used to train a machine learning model with thoroughly optimised training parameters.

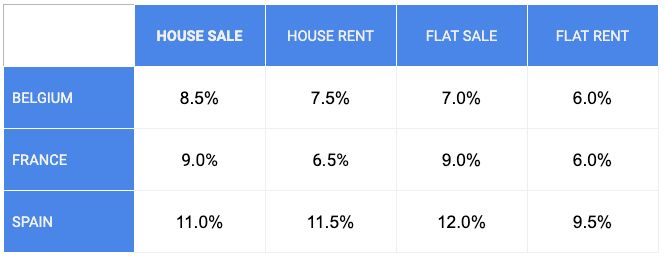

Realo currently has multiple models, making distinctions between sale prices, rental prices, (re-)building values, land values, as well as different types of property (e.g. houses, flats and ground). On top of that, Realo is active in three countries: Belgium, France and Spain.

Each model is updated quarterly with the newest available data and data modelling techniques. They are also regularly validated and backtested against a continuously updating testing set of both listing prices and transaction prices. To quantify the quality of the models, Realo uses the Median Relative Error (MRE) metric. The current MRE values that each model achieves are shown in the table below.

Aside from producing automated valuations, the Valuation Engine also calculates confidence and feature importance metrics. These respectively represent how confident the engine is in its valuation and what characteristics of the property contributed most to its valuation. This way the engine provides a level of certainty and interpretability to each appraisal.

EBA Requirements for statistical models

The requirements the EBA describes for the valuation of immovable property by advanced statistical models are the following:

Institutions should ensure that the advanced statistical models used are: - property and location specific at a sufficient level of granularity (e.g. postcode for immovable property collateral); - valid and accurate, and subject to robust and regular backtesting against the actual observed transaction prices; - based on a sufficiently large and representative sample, based on observed transaction prices; - based on up-to-date data of high quality.

Realo’s Valuation engine satisfies these criteria:

The EBA guidelines further specify that:

Institutions should critically review the valuation they receive, from the valuer, in particular focusing on aspects such as comprehensibility (whether the approaches and assumptions are clear and transparent), the prudence of assumptions (e.g. as regards cash flow and discount rates), and the clear and reasonable identification of comparable properties used as a value benchmark.

Realo’s Valuation engine uses feature importance metrics to deduce what aspects of a property contributed most to its valuation, making the estimates explainable by EBA standards. Realo also has a large amount of data pertaining to the liquidity of properties on multiple levels of locational granularity. Furthermore, we make use of recommendation systems to provide listing prices of comparable properties which can be used as a value benchmark for the valuations.

Conclusion

Starting on January 1st, 2022, loan institutions will be required to enlist third party valuers to appraise property provided as collateral for loans. As physical property visits by experts are expensive, it is ideal to use statistical modelling to do these appraisals instead.

This paper gave a brief overview of Realo’s Valuation Engine and detailed how it satisfies all the criteria put forth by the EBA regarding property valuations by statistical models. It showed how this engine is an ideal solution as a third party appraisal tool for loan institutions given the new guidelines.